We offer free consultations and retirement planning, Medicare & life-insurance planning to empower your confidence and protect your life—not just your money.

Trusted

As a Christian and trusted advisor, Garry has been helping seniors with their Retirement and Medicare needs for over 40 years.

Hundreds of clients throughout the Southeast United States have placed their trust in his ability to help them understand the pros and cons of Medicare and Retirement Planning. Garry has also been pastoring churches for the last 20 years and in the ministry for over 30 years.

Independent status allows access to more quality choices

Places his clients’ interests first. Always!

Provides the absolute best in customer service

$0 consultation fee

Integrity-based work

Fiduciary standard of excellence

Hundreds of satisfied clients

Supplies up-to-date information at educational workshops.

Medicare Parts A, B, C, D

Navigating Medicare can be confusing. As part of your overall retirement planning, we simplify the process by explaining how each part works—Hospital (A), Medical (B), Advantage (C), and Prescription Drug Coverage (D)—and help you select the right combination for comprehensive protection.

Intro to Medicare Workshops

If you are 64 to 68 years old and haven’t signed up for Medicare, this seminar is for you!

Long-Term Care

As part of a complete retirement planning strategy, we offer solutions to help cover the costs of care that regular health insurance or Medicare may not provide. These plans help preserve your independence and protect your savings should you ever need extended care at home or in a facility.

Annuities

Offering fixed and indexed annuities that provide guaranteed returns or lifetime income. Annuities can help stabilize your portfolio and serve as a foundation for long-term retirement security.

Dental and Vision

Affordable coverage options to maintain your overall health and well-being. These plans help reduce out-of-pocket costs for routine dental care, eye exams, glasses, and other essential services.

Retirement Planning

Helping you create a personalized plan for your retirement years by evaluating income needs, savings strategies, and investment options. The goal is to ensure you have financial stability and peace of mind throughout your retirement.

Health Insurance

Providing guidance and coverage options to protect against high medical costs. We help you compare plans and choose the right health insurance to fit your lifestyle, needs, and budget.

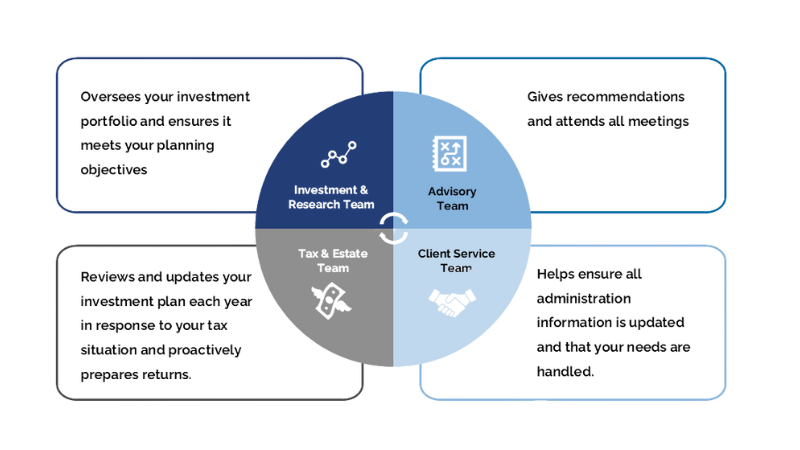

The Solutions for Seniors Team

Garry Edwards

NSSA®

Founder & Senior Advisor

Matt Glass

NSSA® CRPC® IRMAA®

Aaron Schmidtke

Portfolio Allocation Manager

Gene Perez

Certified Financial Planner & Investment Allocation Manager

Charles Johnson

HR & Compliance Manager

Mitch Whitney

Marketing Director

Frequently Asked Questions

What Is an NSSA® Advisor?

An NSSA® (National Social Security Advisor) is a specially trained professional who has completed advanced education in Social Security planning. NSSA® advisors understand the rules, benefits, and claiming strategies that can help you maximize your lifetime Social Security income. By working with an NSSA® advisor, you gain clear, personalized guidance to make informed decisions about when and how to claim your benefits—ensuring your retirement strategy aligns with your long-term financial goals.

Why should I work with an independent advisor?

As an independent advisor, Garry is not tied to any one company or product. That means he can shop the market and recommend only the best options that fit your personal needs and budget—not what benefits an insurance carrier.

What makes Solutions for Seniors different?

With over 38 years of experience helping seniors across the Southeast, Garry Edwards combines professional expertise with a personal, faith-based approach. Integrity, honesty, and client-centered service are the foundation of every recommendation.

When should I start planning for retirement?

It’s never too early—or too late—to plan. Most clients begin serious retirement planning in their 50s or early 60s, but Garry helps individuals at all stages build strategies for secure, predictable income throughout retirement.

How do I get started?

Simply call 888-520-0922 or complete the contact form on our website to schedule your complimentary consultation. Garry will meet with you personally to review your current situation and help you explore your best options for coverage and peace of mind.